The Lyft stock price has become a focal point for investors and analysts alike, especially as the ride-sharing industry continues to evolve. With increasing competition and changing consumer behaviors, understanding the factors that influence Lyft's stock price is crucial for making informed investment decisions. In this article, we will delve deep into Lyft's stock performance, recent trends, and what the future may hold for this prominent player in the transportation market. By the end of this piece, you will have a thorough understanding of the dynamics behind Lyft's stock price.

Lyft, founded in 2012, quickly became one of the leading ride-sharing services in the United States. However, like many tech companies, its stock has experienced significant volatility since its IPO in 2019. This volatility can often be attributed to various external factors such as market conditions, company performance, and broader economic indicators. Therefore, it is essential to analyze these components to gain insights into Lyft's stock price movements.

As we explore the various aspects of Lyft's stock price, we will cover topics including the company's financial health, competitive landscape, market trends, and expert opinions. This comprehensive approach will provide you with the knowledge necessary to navigate the complexities of investing in Lyft's stock. Let's begin our journey into understanding Lyft's stock price.

Table of Contents

- 1. Company Overview

- 2. Financial Performance of Lyft

- 3. Competitive Landscape

- 4. Market Trends Influencing Lyft Stock Price

- 5. Analyst Opinions and Forecasts

- 6. Historical Stock Price Trends

- 7. Risks and Challenges for Lyft

- 8. Future Outlook for Lyft Stock Price

- Conclusion

1. Company Overview

Lyft, Inc. is a United States-based ride-sharing company that provides transportation services through a mobile app. It was founded by Logan Green and John Zimmer in June 2012, and its headquarters is located in San Francisco, California. Lyft operates in over 644 cities in the U.S. and Canada, making it one of the largest ride-sharing platforms in North America.

1.1 Key Details About Lyft

| Detail | Information |

|---|---|

| Name | Lyft, Inc. |

| Founded | June 2012 |

| Headquarters | San Francisco, California |

| CEO | Logan Green |

| IPO Date | March 29, 2019 |

| Ticker Symbol | LYFT |

2. Financial Performance of Lyft

To understand Lyft's stock price, it is essential to evaluate its financial performance. A company's financial health is often reflected in key metrics such as revenue, profit margins, and earnings per share (EPS).

2.1 Revenue Growth

Lyft has shown significant revenue growth over the years. According to their financial statements, Lyft reported a revenue of $3.6 billion in 2022, a substantial increase from previous years. However, as the company scales, investors should also consider the sustainability of this growth.

2.2 Profit Margins

The profitability of Lyft has been a crucial topic among analysts. Despite the impressive revenue growth, the company has struggled to achieve consistent profitability. In recent quarters, Lyft has reported operating losses, which has raised concerns among investors. Monitoring the company's efforts to improve profit margins will be vital moving forward.

3. Competitive Landscape

The ride-sharing market is highly competitive, with major players such as Uber, DoorDash, and new entrants continuously emerging. Understanding Lyft's position in this competitive landscape is essential for evaluating its stock price.

3.1 Major Competitors

- Uber Technologies, Inc.

- DoorDash, Inc.

- Via Transportation, Inc.

Uber remains Lyft's most significant competitor, controlling a substantial share of the market. The competition between these two companies has led to price wars and promotional offers, impacting profit margins across the board. Thus, investors must consider how Lyft can differentiate itself in a crowded marketplace.

4. Market Trends Influencing Lyft Stock Price

Market trends can significantly impact Lyft's stock price. Factors such as consumer behavior, regulatory changes, and economic conditions play a crucial role in shaping investor sentiment.

4.1 Consumer Behavior

As people increasingly prioritize convenience and cost-effectiveness in transportation, understanding consumer trends is vital. Lyft's ability to adapt to shifting consumer preferences will influence its market position and, subsequently, its stock price.

4.2 Regulatory Environment

Changes in regulations, such as those pertaining to gig economy workers, can also affect Lyft's operational costs. Investors should stay informed about any potential legislative changes that may impact the ride-sharing industry.

5. Analyst Opinions and Forecasts

Analyst opinions can provide valuable insights into Lyft's potential stock performance. Many analysts offer price targets based on their assessments of the company's fundamentals and market trends.

5.1 Price Targets

As of the latest reports, analysts have varied opinions on Lyft's stock price target, with estimates ranging from $20 to $50. The disparity among analysts reflects differing views on the company's growth potential and market challenges.

5.2 Investment Recommendations

- Buy: Analysts who believe in Lyft's long-term potential recommend buying the stock.

- Hold: Some analysts suggest holding the stock until more clarity emerges regarding profitability.

- Sell: A few analysts advise selling based on Lyft's recent performance and market competition.

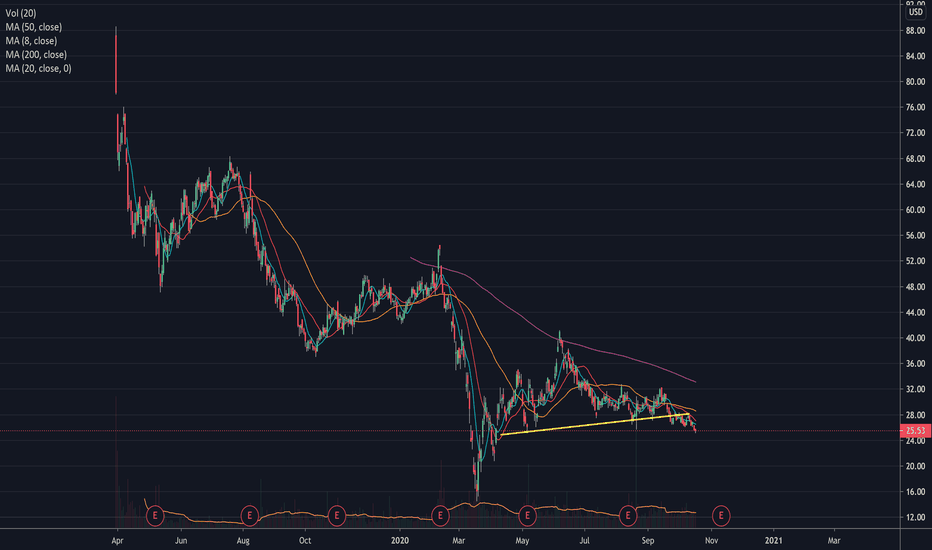

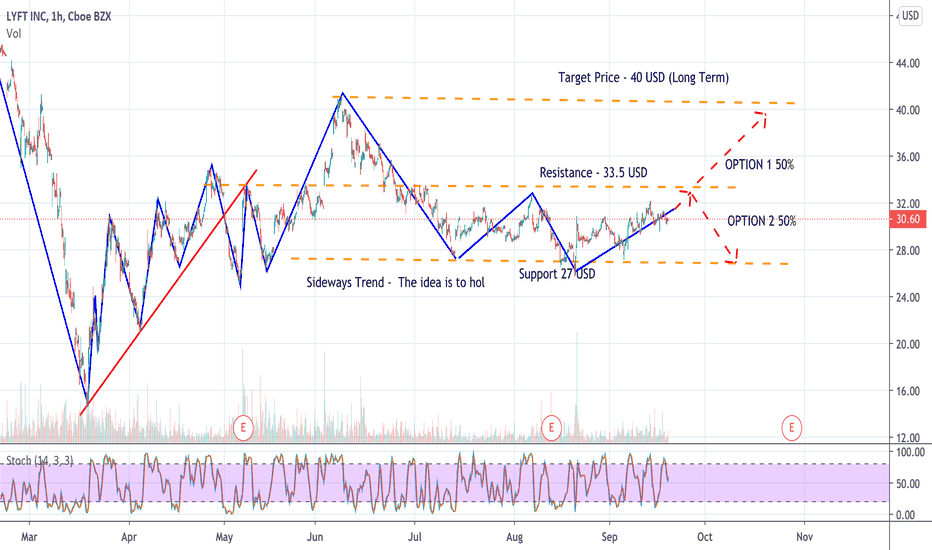

6. Historical Stock Price Trends

Examining Lyft's historical stock price trends can provide insights into its volatility and potential future movements. Since its IPO, Lyft's stock has experienced substantial fluctuations influenced by various external factors.

6.1 Initial Public Offering (IPO)

Lyft went public on March 29, 2019, at an initial price of $72 per share. The stock saw a sharp rise in its early trading days before experiencing a significant decline. Understanding the events leading to these fluctuations can help investors assess the stock's potential.

6.2 Recent Performance

In recent months, Lyft's stock has shown signs of recovery, but concerns about profitability and competition continue to loom. Investors should closely monitor changes in stock performance as new data and developments emerge.

7. Risks and Challenges for Lyft

Like any investment, there are inherent risks and challenges associated with Lyft's stock. Understanding these risks is essential for making informed investment decisions.

7.1 Market Volatility

The ride-sharing industry is subject to rapid changes, making Lyft's stock price volatile. Investors must be prepared for fluctuations based on market conditions and consumer demand.

7.2 Competition

As mentioned earlier, competition from other ride-sharing companies poses a significant challenge for Lyft. Staying ahead in technology and service offerings is crucial for maintaining market share.

8. Future Outlook for Lyft Stock Price

Looking ahead, the future outlook for Lyft's stock price largely depends on the company's ability to execute its business strategies effectively. Factors such as expanding service offerings, improving profitability, and adapting to market trends will be critical.

8.1 Growth Opportunities

- Expansion into new markets

- Increased investment in technology

- Partnerships with other transportation services

By capitalizing on these growth opportunities, Lyft can bolster its stock price and appeal to investors.

Conclusion

In conclusion, understanding Lyft's stock price involves analyzing various factors, including its financial performance, competitive landscape, market trends, and analyst opinions. While the ride-sharing industry presents both opportunities and challenges, Lyft's ability

Chocolate Liqueur Candy: A Decadent Delight For The Senses

The Bank Of Princeton: A Comprehensive Overview

Exploring The Life And Relationships Of Marc Anthony: His Spouse And Beyond