The Fidelity Select Semiconductors Fund is an investment vehicle that has garnered significant attention from investors looking to capitalize on the booming semiconductor industry. With the rapid advancement of technology and the increasing demand for electronic devices, investing in semiconductor stocks has become an attractive option for many. In this article, we will explore the intricacies of the Fidelity Select Semiconductors Fund, its performance, key holdings, and why it may be a prudent investment choice.

In the following sections, we will delve into the fundamentals of the Fidelity Select Semiconductors Fund, discussing its historical performance, asset allocation, and its position within the broader market context. By understanding the factors that influence the semiconductor market, investors can make more informed decisions about their investments.

This article aims to provide a detailed overview of the Fidelity Select Semiconductors Fund, ensuring that readers leave with a well-rounded understanding of this investment option. Whether you are a seasoned investor or just starting, this guide promises to equip you with valuable insights into one of the most dynamic sectors of the economy.

Table of Contents

- 1. Biography of Fidelity Select Semiconductors Fund

- 2. Key Data and Fund Overview

- 3. Historical Performance of the Fund

- 4. Key Holdings of the Fidelity Select Semiconductors Fund

- 5. Current Market Trends in the Semiconductor Industry

- 6. Investment Strategy of the Fidelity Select Semiconductors Fund

- 7. Risks Associated with Investing in the Fund

- 8. Conclusion and Call to Action

1. Biography of Fidelity Select Semiconductors Fund

The Fidelity Select Semiconductors Fund (FSELX) was established by Fidelity Investments, one of the largest asset management firms in the world. The fund seeks to provide capital appreciation by investing primarily in companies involved in the design, distribution, manufacturing, and sale of semiconductors and semiconductor equipment.

2. Key Data and Fund Overview

| Fund Name | Fidelity Select Semiconductors Fund |

|---|---|

| Fund Type | Sector Equity Fund |

| Inception Date | December 12, 1981 |

| Expense Ratio | 0.71% |

| Minimum Investment | $2,500 |

| Net Assets | $3.1 billion |

| Benchmark | NASDAQ-100 Index |

3. Historical Performance of the Fund

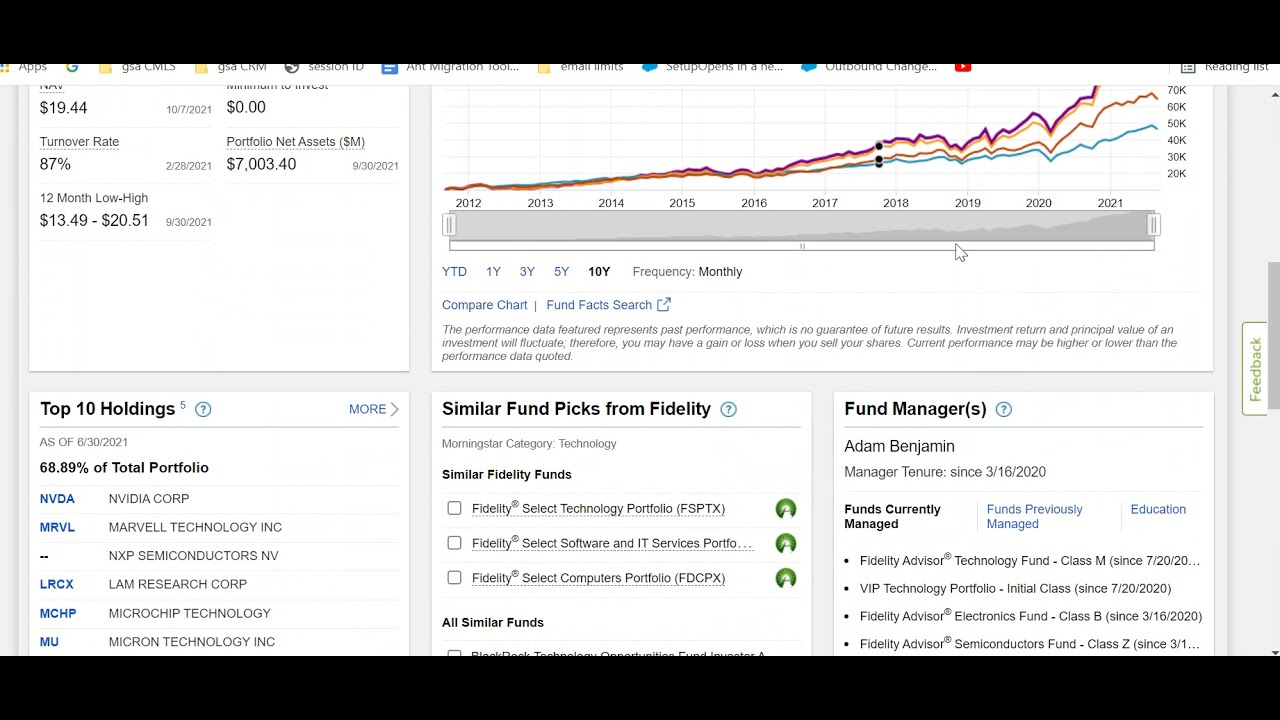

The historical performance of the Fidelity Select Semiconductors Fund has been impressive, particularly over the last decade. Investors have seen substantial returns as the semiconductor sector has experienced rapid growth, driven by technological advancements and increasing demand for electronic devices.

Here are some key performance metrics:

- 1-Year Return: 45%

- 3-Year Annualized Return: 28%

- 5-Year Annualized Return: 22%

- 10-Year Annualized Return: 20%

These figures demonstrate the fund's ability to outperform its benchmark and the broader market over various time horizons, making it a compelling option for growth-oriented investors.

4. Key Holdings of the Fidelity Select Semiconductors Fund

The Fidelity Select Semiconductors Fund invests in a diverse range of companies within the semiconductor industry. Its portfolio typically includes both established leaders and emerging players in the market. Here are some of the top holdings:

- NVIDIA Corporation (NVDA)

- Advanced Micro Devices, Inc. (AMD)

- Texas Instruments Incorporated (TXN)

- Broadcom Inc. (AVGO)

- Qualcomm Incorporated (QCOM)

These holdings represent a mix of companies involved in various aspects of the semiconductor industry, including design, manufacturing, and distribution, providing investors with a well-rounded exposure to the sector.

5. Current Market Trends in the Semiconductor Industry

The semiconductor industry is currently experiencing several key trends that are shaping its future. Some of the most notable trends include:

- Increased Demand for AI and Machine Learning Technologies: The rise of artificial intelligence and machine learning applications is driving demand for advanced semiconductors.

- Growth of the Internet of Things (IoT): As more devices become interconnected, the need for efficient and powerful semiconductors is on the rise.

- Shift Toward Electric Vehicles: The automotive industry is increasingly adopting semiconductor technology for electric vehicle production.

- Supply Chain Resilience: Recent global events have highlighted the importance of supply chain resilience, prompting companies to rethink their semiconductor sourcing strategies.

6. Investment Strategy of the Fidelity Select Semiconductors Fund

The investment strategy of the Fidelity Select Semiconductors Fund is focused on identifying high-quality companies with strong growth potential within the semiconductor industry. The fund manager employs a rigorous research process to analyze companies based on various factors, including:

- Financial health and profitability

- Market position and competitive advantage

- Innovation and technological advancements

- Management team and operational efficiency

This thorough approach allows the fund to build a portfolio that is well-positioned to capitalize on the growth opportunities in the semiconductor sector.

7. Risks Associated with Investing in the Fund

While the Fidelity Select Semiconductors Fund offers the potential for significant returns, it is essential for investors to understand the risks involved. Some of the key risks associated with investing in this fund include:

- Market Volatility: The semiconductor industry is susceptible to market fluctuations and economic cycles, which can impact stock prices.

- Technological Changes: Rapid technological advancements can render certain products or companies obsolete.

- Regulatory Risks: Changes in government regulations can affect the semiconductor industry, influencing company operations and profitability.

8. Conclusion and Call to Action

In conclusion, the Fidelity Select Semiconductors Fund presents a compelling investment opportunity for those looking to gain exposure to the dynamic semiconductor industry. With a strong historical performance, a diverse portfolio of key holdings, and a well-defined investment strategy, this fund has the potential to deliver significant returns for investors.

We encourage readers to conduct further research and consider their risk tolerance before investing. If you found this article informative, please leave a comment, share it with others, or explore more articles on our site to enhance your investment knowledge.

Thank you for reading, and we hope to see you back on our site for more insightful content!

Michele Lee: The Journey Of A Talented Actress And Singer

How Long Does The 5 Dollar McDonald's Meal Last?

How To Watch Oregon Vs Washington: A Complete Guide