US income classification is a crucial aspect of understanding the economic landscape of the United States. It not only helps in analyzing the distribution of wealth but also influences policy-making, taxation, and social services. In this article, we will explore the various classifications of income in the US, the criteria for each classification, and the implications of these classifications on society and the economy.

The classification of income in the US is typically categorized based on various factors such as household size, geographic location, and socio-economic status. This guide aims to provide a thorough understanding of the income classification system, its relevance, and the impact it has on individuals and families across the nation.

Whether you are a student, a policy maker, or simply someone interested in understanding the economic dynamics of the US, this article will equip you with the knowledge you need about US income classification.

Table of Contents

- What is Income Classification?

- Importance of Income Classification

- Types of Income Classification

- Factors Affecting Income Classification

- Government Programs and Income Classification

- Statistical Data on Income Classification

- Challenges in Income Classification

- Future of Income Classification

What is Income Classification?

Income classification refers to the categorization of individuals or households based on their income levels. This classification helps in understanding the economic status of various segments of the population and is essential for effective policy-making and resource allocation.

In the US, income classification is often used to determine eligibility for government assistance programs, taxation rates, and social services. It plays a significant role in shaping the financial landscape and understanding the economic disparities present in society.

Importance of Income Classification

Understanding income classification is vital for several reasons:

- Policy-making: It helps lawmakers develop policies that address poverty and inequality.

- Resource Allocation: Assists in the distribution of resources to those in need.

- Economic Analysis: Provides insights into the economic health of the nation and its citizens.

Types of Income Classification

Income classification can be categorized in various ways, with the most common methods being based on household income and individual income.

By Household Income

Household income classification divides households into various income brackets. The US Census Bureau typically defines these brackets as follows:

- Low Income: Households earning less than 50% of the median income.

- Middle Income: Households earning between 50% and 150% of the median income.

- High Income: Households earning more than 150% of the median income.

By Individual Income

Individual income classification is similar but focuses on income earned by individuals rather than households. This classification is often used in tax brackets and social security benefits.

- Low Income: Individuals earning less than $25,000 annually.

- Middle Income: Individuals earning between $25,000 and $75,000 annually.

- High Income: Individuals earning more than $75,000 annually.

Factors Affecting Income Classification

Several factors influence income classification in the US:

- Geographic Location: Income levels can vary significantly based on location, with urban areas typically having higher income levels than rural areas.

- Education Level: Higher educational attainment often correlates with higher income levels.

- Occupation: Certain professions tend to pay more than others, affecting the income classification.

Government Programs and Income Classification

Various government programs utilize income classification to determine eligibility for assistance. Some of these programs include:

- Medicaid: Provides healthcare coverage for low-income individuals and families.

- Food Stamps (SNAP): Assists low-income households in purchasing food.

- Public Housing: Offers affordable housing options for low-income families.

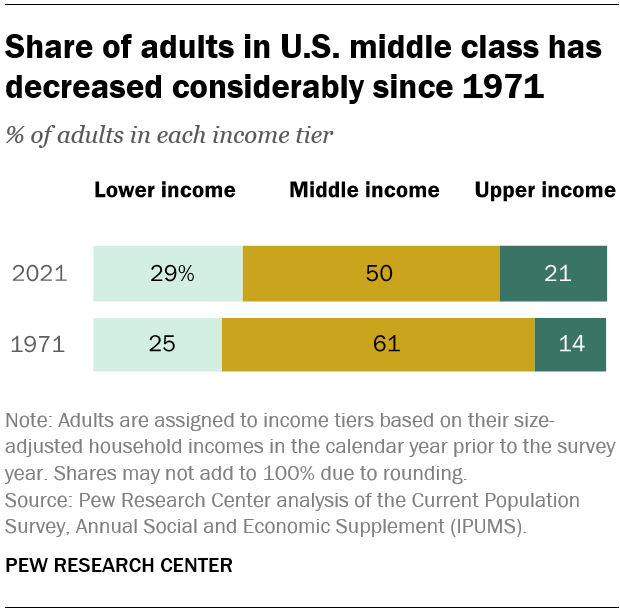

Statistical Data on Income Classification

According to the U.S. Census Bureau, the median household income in 2021 was approximately $70,000, with significant disparities across different demographics and regions. Understanding these statistics is essential for grasping the broader implications of income classification.

Moreover, the following statistics highlight the income distribution in the US:

- Approximately 10% of households earn less than $15,000 annually.

- About 30% of households earn between $50,000 and $100,000.

- Only 5% of households earn more than $200,000 annually.

Challenges in Income Classification

While income classification is a helpful tool, it also faces several challenges:

- Data Collection: Gathering accurate and comprehensive data can be difficult.

- Changing Economic Conditions: Economic fluctuations can rapidly alter income levels.

- Social Factors: Issues such as discrimination and systemic inequality can affect income distribution.

Future of Income Classification

The future of income classification in the US will likely evolve as economic conditions change. Trends such as remote work and the gig economy may reshape traditional income classifications, requiring policymakers to adapt their approaches.

Moreover, increasing awareness of income inequality may lead to more nuanced classifications that account for factors beyond mere income level, such as wealth accumulation and access to resources.

Conclusion

In summary, understanding US income classification is essential for grasping the complexities of the economic landscape. By recognizing the various classifications, their importance, and the factors that influence them, individuals and policymakers can work towards a more equitable society.

We encourage you to share your thoughts and insights in the comments below. If you found this article helpful, consider sharing it with others who may benefit from this information or explore other articles on our site for a deeper understanding of economic issues.

Closing Thoughts

Thank you for reading our comprehensive guide on US income classification. We hope you found it informative and engaging. Be sure to return for more insightful articles that delve into important economic topics.

Cheapest States To Retire: Your Ultimate Guide To Affordable Living

Understanding FedEx Dividend: A Comprehensive Guide

Aliens In The Attic: A Comprehensive Exploration Of The Cult Classic